Volkswagen Group deliveries

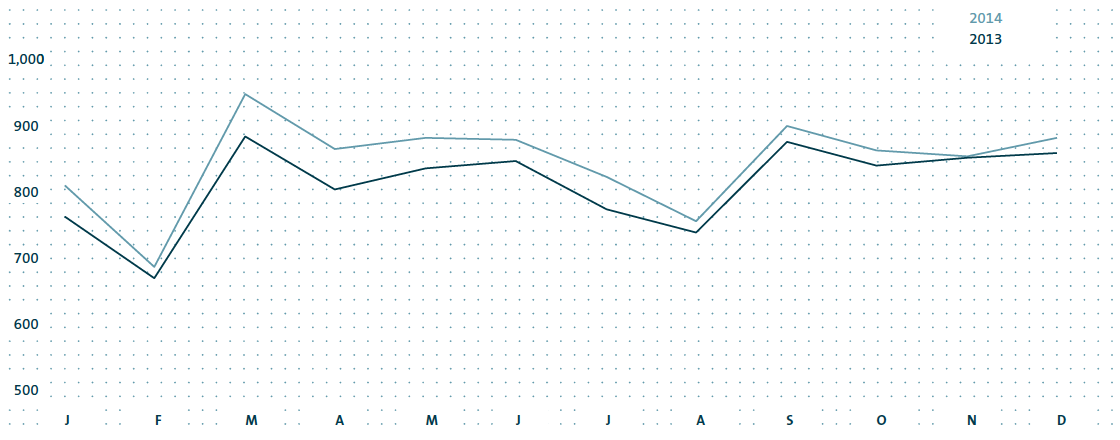

In fiscal year 2014, the Volkswagen Group increased its deliveries to customers worldwide by 4.2% to 10,137,387 vehicles, exceeding the 10 million mark for the first time in the Company’s history. We have thus met the target originally set for 2018 four years early. As the chart on this page shows, the delivery figures were higher in all twelve months of the reporting period than in the same months of 2013. Details of deliveries of passenger cars and commercial vehicles are provided separately in the following.

| (XLS:) |

|

VOLKSWAGEN GROUP DELIVERIES* |

||||||||

|

|

2014 |

2013 |

% | |||||

|---|---|---|---|---|---|---|---|---|

|

|

|

|

|

|||||

|

||||||||

|

Passenger cars |

9,490,921 |

9,047,417 |

+4.9 |

|||||

|

Commercial vehicles |

646,466 |

683,170 |

−5.4 |

|||||

|

Total |

10,137,387 |

9,730,587 |

+4.2 |

|||||

VOLKSWAGEN GROUP DELIVERIES BY MONTH

Vehicles in thousands

PASSENGER CAR DELIVERIES WORLDWIDE

With its brands, the Volkswagen Group has a presence in all relevant automotive markets around the world. Western Europe, China, Brazil, the USA, Russia and Mexico are currently the key sales markets for the Group. The Group maintained its strong competitive position in the reporting period thanks to its wide range of attractive and environmentally friendly models. We recorded an encouraging increase in demand in many of our key markets.

In the reporting period, the Volkswagen Group delivered 9,490,921 passenger cars to customers, exceeding the record prior-year level by 4.9%. The market as a whole only grew by 4.5% in the same period, meaning that the Group’s share of the global market increased to 12.9% (12.8%). The Volkswagen Passenger Cars (+1.6%), Audi (+10.5%), ŠKODA (+12.7%), Bentley (+8.9%), Lamborghini (+19.3%) and Porsche (+17.1%) brands recorded their best ever delivery figures in the year under review. For the first time in a calendar year, Volkswagen Passenger Cars sold more than 6 million vehicles and ŠKODA’s sales exceeded 1 million units. Demand for Volkswagen Group passenger cars grew fastest in the Asia-Pacific region, with China recording the highest absolute increase.

The table below gives an overview of deliveries to customers of the Volkswagen Group in the key individual markets and regions. We describe the demand trends for Group models in these markets and regions in the following sections.

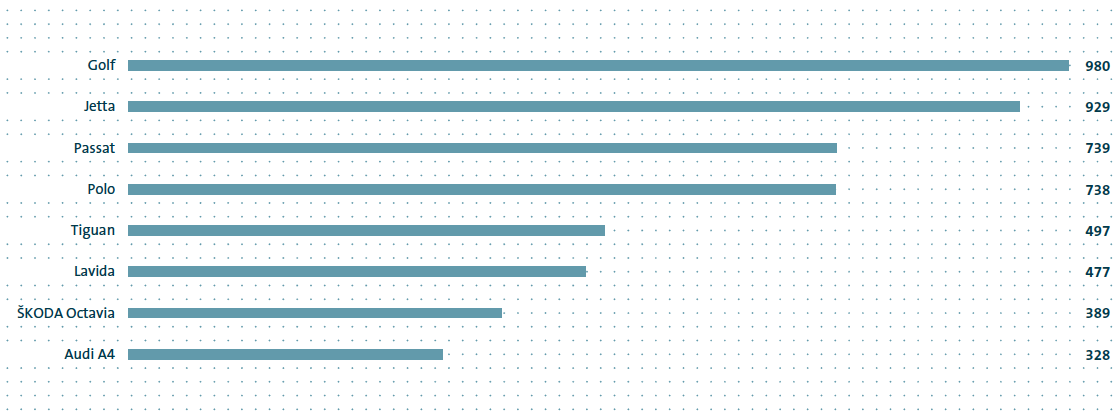

WORLDWIDE DELIVERIES OF THE GROUP'S MOST SUCCESSFUL MODELS IN 2014

Vehicles in thousands

Deliveries in Europe/Other markets

In Western Europe, the passenger car market as a whole stabilized in the reporting period, growing 4.9% year-on-year. The Volkswagen Group outperformed the market as a whole, increasing its deliveries to customers by 6.5% to 2,912,905 units. Demand for Group models was up year-on-year in all major markets in this region. The Golf, Audi A3, ŠKODA Octavia and SEAT Ibiza were among the models to see increases. Demand for the SEAT Leon ST was particularly strong. The Porsche Macan was successfully launched in the market. The Group increased its share of the passenger car market in Western Europe to 25.1% (24.9%).

The number of Volkswagen Group passenger cars delivered in Central and Eastern Europe in the reporting period was up 1.3% on the prior-year figure. This means that we also outperformed the market as a whole in this region (−6.7%). While demand for the Group’s vehicles in Poland and the Czech Republic, among other

countries, was significantly higher year-on-year, sales in Russia and Ukraine declined as a result of the political crisis. The Golf Estate, Audi A3, ŠKODA Rapid and SEAT Ibiza models recorded the strongest growth. The Group’s share of the passenger car market in Central and Eastern Europe rose to 17.0% (15.6%).

The reporting period saw 3.6% fewer vehicles delivered to customers in the declining South African passenger car market than in 2013. However, the Polo and Audi A3 models recorded increased demand.

Demand for Group vehicles in the Middle East region grew by 1.3% compared with the previous year. The Polo, Jetta and Golf models were particularly popular.

Deliveries in Germany

The German passenger car market registered modest growth of 2.9% in the reporting period. In the same period, the Volkswagen Group increased sales to customers in its home market by 4.6% year-on-year. The Golf, Tiguan, Audi A6, ŠKODA Rapid and SEAT Alhambra models recorded encouraging growth rates. In addition, the SEAT Leon ST proved extremely popular. Seven Volkswagen Group models led the Kraftfahrt-Bundesamt (KBA – German Federal Motor Transport Authority) registration statistics in their respective segments at the end of 2014: the up!, Polo, Golf, Passat, Audi A6, Tiguan and Touran. The Golf continues to be the most popular passenger car in Germany in terms of registrations.

Deliveries in North America

In North America, the number of Volkswagen Group vehicles delivered in 2014 was on a level with the previous year. The Group’s share of the passenger car market amounted to 4.6% (4.8%).

The market as a whole in the USA grew by 5.9%. Demand was particularly strong for models in the SUV segment. The Volkswagen Group sold 2.0% fewer vehicles in the USA than in the previous year. Demand for the Golf, Audi Q7, Audi Q5 and Porsche 911 Coupé models recorded positive growth.

The Group’s sales in Mexico were up 2.0% year-on-year. Demand for the Gol, Audi A3 and SEAT Toledo models and for the newly launched Vento was very encouraging.

We delivered 9.6% more vehicles to customers in Canada than in 2013. The Jetta was the most sought-after Group model. The Audi Q5 and Porsche Macan models were also popular.

Deliveries in South America

Conditions in the highly competitive South American markets increasingly deteriorated in the reporting period. The Volkswagen Group delivered 17.0% fewer vehicles to customers in the generally sharply declining markets in this region than in the previous year. The Group’s share of the passenger car market in the region declined to 17.8% (18.9%).

In the contracting Brazilian market, demand for Volkswagen Group vehicles declined by 12.1%. However, the Saveiro, Golf, Audi A3 and Audi Q3 models saw increases. The up! was successfully launched in the market.

In Argentina, our deliveries to customers in 2014 were down 39.2% on the prior-year level; the market as a whole fell by 30.0%. However, the Gol was still the most popular car in terms of registrations.

Deliveries in the Asia-Pacific region

The Volkswagen Group increased its passenger car sales in the Asia-Pacific region by 11.2% in 2014. We thus outperformed the market as a whole, which grew by 7.6% in the same period. The Volkswagen Group’s share of the passenger car market in this region increased to 13.3% (12.9%).

The Chinese market continued to drive growth in the Asia-Pacific region in 2014, increasing by 12.1%. We delivered 12.3% more vehicles year-on-year to customers in China in the reporting period. The Golf, Santana, Gran Lavida, Audi Q3, ŠKODA Rapid and Porsche Panamera models recorded the strongest growth.

In Japan, we handed over 3.7% more vehicles to customers in the year under review than in 2013 and outperformed the passenger car market as a whole, which rose by 2.9%. The Golf and Audi A3 models in particular saw increases.

Sales in India were down 23.7% year-on-year in a slightly rising market. The most sought-after Group model was the Polo; the Audi Q3 and ŠKODA Rapid models were also popular.

| (XLS:) |

|

PASSENGER CAR DELIVERIES TO CUSTOMERS BY MARKET* | ||||||||

|---|---|---|---|---|---|---|---|---|

|

|

DELIVERIES (UNITS) |

CHANGE |

||||||

|

|

2014 |

2013 |

(%) | |||||

|

|

|

|

|

|||||

|

||||||||

|

Europe/Other markets |

3,893,726 |

3,715,349 |

+4.8 |

|||||

|

Western Europe |

2,912,905 |

2,734,534 |

+6.5 |

|||||

|

of which: Germany |

1,092,675 |

1,044,477 |

+4.6 |

|||||

|

United Kingdom |

510,481 |

454,400 |

+12.3 |

|||||

|

France |

249,311 |

245,926 |

+1.4 |

|||||

|

Italy |

190,671 |

176,231 |

+8.2 |

|||||

|

Spain |

203,870 |

173,893 |

+17.2 |

|||||

|

Central and Eastern Europe |

606,801 |

599,231 |

+1.3 |

|||||

|

of which: Russia |

253,176 |

287,258 |

−11.9 |

|||||

|

Czech Republic |

100,967 |

83,215 |

+21.3 |

|||||

|

Poland |

95,790 |

75,920 |

+26.2 |

|||||

|

Other markets |

374,020 |

381,584 |

−2.0 |

|||||

|

of which: Turkey |

128,592 |

126,853 |

+1.4 |

|||||

|

South Africa |

100,058 |

103,805 |

−3.6 |

|||||

|

North America |

884,454 |

884,440 |

+0.0 |

|||||

|

of which: USA |

599,734 |

611,747 |

−2.0 |

|||||

|

Mexico |

189,328 |

185,640 |

+2.0 |

|||||

|

Canada |

95,392 |

87,053 |

+9.6 |

|||||

|

South America |

690,101 |

831,465 |

−17.0 |

|||||

|

of which: Brazil |

554,828 |

631,383 |

−12.1 |

|||||

|

Argentina |

95,086 |

156,443 |

−39.2 |

|||||

|

Asia-Pacific |

4,022,640 |

3,616,163 |

+11.2 |

|||||

|

of which: China |

3,668,433 |

3,266,235 |

+12.3 |

|||||

|

Japan |

104,218 |

100,535 |

+3.7 |

|||||

|

India |

70,656 |

92,561 |

−23.7 |

|||||

|

Worldwide |

9,490,921 |

9,047,417 |

+4.9 |

|||||

|

Volkswagen Passenger Cars |

6,118,617 |

6,021,750 |

+1.6 |

|||||

|

Audi |

1,741,129 |

1,575,480 |

+10.5 |

|||||

|

ŠKODA |

1,037,226 |

920,750 |

+12.7 |

|||||

|

SEAT |

390,505 |

355,004 |

+10.0 |

|||||

|

Bentley |

11,020 |

10,120 |

+8.9 |

|||||

|

Lamborghini |

2,530 |

2,121 |

+19.3 |

|||||

|

Porsche |

189,849 |

162,145 |

+17.1 |

|||||

|

Bugatti |

45 |

47 |

−4.3 |

|||||

COMMERCIAL VEHICLE DELIVERIES

The Volkswagen Group delivered a total of 646,466 commercial vehicles to customers worldwide in the reporting period, 5.4% fewer than in the previous year. Trucks accounted for 179,592 units (−9.3%), and buses accounted for 20,278 (−11.0%). Sales by the Volkswagen Commercial Vehicles brand were down 3.4% on the prior-year figure, with 446,596 vehicles delivered. The MAN brand handed over 120,088 vehicles to customers in 2014, 14.4% fewer than in the previous year. The Scania brand’s deliveries were almost unchanged year-on-year at 79,782 (−0.8%).

In Western Europe, the Group’s commercial vehicle sales were up 3.5% in 2014 compared with the previous year, at a total of 361,372 units; of this figure, 292,042 were light commercial vehicles, 65,539 were trucks and 3,791 were buses. This increase was largely attributable to the improved economic environment, which was particularly beneficial to the market for light commercial vehicles. The Caddy and T5 models were the most sought-after models here.

In the period from January to December 2014, we handed over a total of 64,052 vehicles to customers (−7.2%) in Central and Eastern Europe, consisting of 37,698 light commercial vehicles, 25,743 trucks and 611 buses. In Russia, the region’s largest market, the low oil price and persistently weak ruble due to the tense political situation led to a 21.5% decline in deliveries to customers. The T5 experienced the highest demand.

In the Other markets, Group sales increased by 8.0% to a total of 72,901 units: 47,166 light commercial vehicles, 23,198 trucks and 2,537 buses.

In North America, the Volkswagen Group increased its deliveries by 2,210 units to 8,331 commercial vehicles; of this figure, 6,031 were light commercial vehicles, 380 were trucks and 1,920 were buses.

Deliveries in the South American markets in the reporting period amounted to 104,728 units, consisting of 40,948 light commercial vehicles and 54,542 trucks. This represents a year-on-year decline of 34.9%. The main driver of this decrease was the Brazilian market, where the negative economic trend and difficult financing conditions led to a 39.4% decline in deliveries. 74,977 units, of which 48,799 were trucks and 7,557 were buses, were handed over to customers. The Amarok was particularly popular in Brazil.

In the Asia-Pacific region, the Volkswagen Group’s commercial vehicle brands delivered 35,082 units in the reporting period −22,711 light commercial vehicles, 10,190 trucks and 2,181 buses: a total of 15.2% more than in the previous year. The T5 and the Amarok were the most sought–after Group models. In the Chinese market, Group sales amounted to 4,453 light commercial vehicles, 2,253 trucks and 181 buses.

| (XLS:) |

|

COMMERCIAL VEHICLE DELIVERIES TO CUSTOMERS BY MARKET* | ||||||||

|---|---|---|---|---|---|---|---|---|

|

|

DELIVERIES (UNITS) |

CHANGE |

||||||

|

|

2014 |

2013 |

(%) | |||||

|

|

|

|

|

|||||

|

||||||||

|

Europe/Other markets |

498,325 |

485,772 |

+2.6 |

|||||

|

Western Europe |

361,372 |

349,208 |

+3.5 |

|||||

|

Central and Eastern Europe |

64,052 |

69,039 |

−7.2 |

|||||

|

Other markets |

72,901 |

67,525 |

+8.0 |

|||||

|

North America |

8,331 |

6,121 |

+36.1 |

|||||

|

South America |

104,728 |

160,834 |

−34.9 |

|||||

|

of which: Brazil |

74,977 |

123,816 |

−39.4 |

|||||

|

Asia-Pacific |

35,082 |

30,443 |

+15.2 |

|||||

|

of which: China |

6,887 |

4,868 |

+41.5 |

|||||

|

Worldwide |

646,466 |

683,170 |

−5.4 |

|||||

|

Volkswagen Commercial Vehicles |

446,596 |

462,373 |

−3.4 |

|||||

|

Scania |

79,782 |

80,464 |

−0.8 |

|||||

|

MAN |

120,088 |

140,333 |

−14.4 |

|||||

DELIVERIES IN THE POWER ENGINEERING SEGMENT

Orders in the Power Engineering segment are usually part of major investment projects. Lead times typically range from just under one year to several years, and partial deliveries as construction progresses are common. Accordingly, there is a time lag between incoming orders and sales revenue from the new construction business.

Sales revenue in the Power Engineering segment was largely driven by Engines & Marine Systems and Turbomachinery, which together generated slightly more than two-thirds of the overall revenue volume. For example, three propulsion engine sets were delivered to a Chinese customer under a major order for six LNG tankers in the reporting period.